Prices are an important indicator of the economy performance. Himachal Pradesh was badly affected by unprecedented rainfalls during the current financial year. Worldwide conflicts the war between Russia and Ukraine and the Israel-Hamas conflict in the Middle East have contributed to global price increases, primarily driven by the rising costs of crude oil and other commodities and weather uncertainties. As a result, Central bank has faced pressure to tighten monetary policy impacting home budgets. The spectre of stagflation, a combination of high inflation and economic stagnation, became a significant concern that needed to be addressed. Consequently, industrialized economies were left no choice but to increase their interest rates.

As the US Federal Reserve raised rates, the United States (US) dollar appreciated, making dollar-denominated fuel imports more expensive. Rising prices are always a cause for concern for policymakers, as they disproportionately impact the common man. The challenges of inflation are more acutely felt in developing economies, where necessities constitute a higher proportion of the consumption basket compared to developed countries.

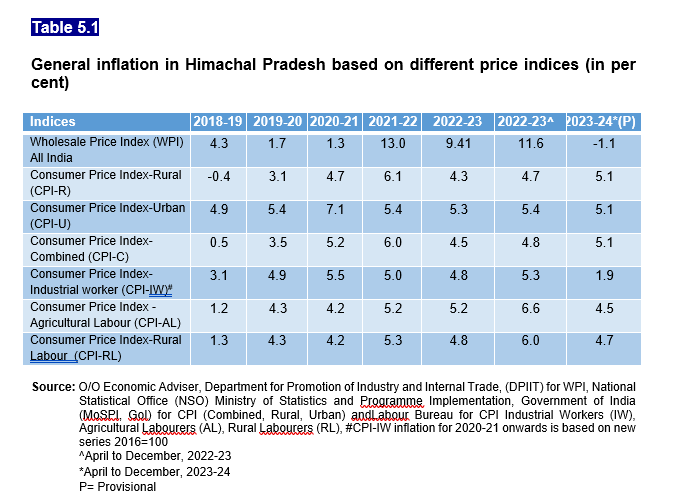

In the case of Himachal Pradesh, the inflation rate has been relatively subdued. India adopted flexible inflation targeting in 2016, and inflation targets are set every five years. In March 2021, the government retained the target at 4 per cent for headline Consumer Price Index (CPI) inflation from April 2021 to March 2026, with lower and upper tolerance limits of 2 per cent and 6 per cent, respectively. This framework provides a guideline for monetary policy to maintain price stability while allowing for some flexibility to accommodate economic conditions.

Supply-side disruptions played a significant role in driving inflation beyond the Reserve Bank of India's (RBI) maximum tolerance range of 6 per cent in the fiscal year 2021-22. The pandemic had a pronounced impact on the supply side than on demand, leading to disruptions in the supply chain for essential items like food, medicine, and industrial goods. Consequently, cost-push inflation in the state was exacerbated as the production and distribution of essential goods faced challenges, causing their prices to rise.

Current Status of Inflation:

Current Status of Inflation:

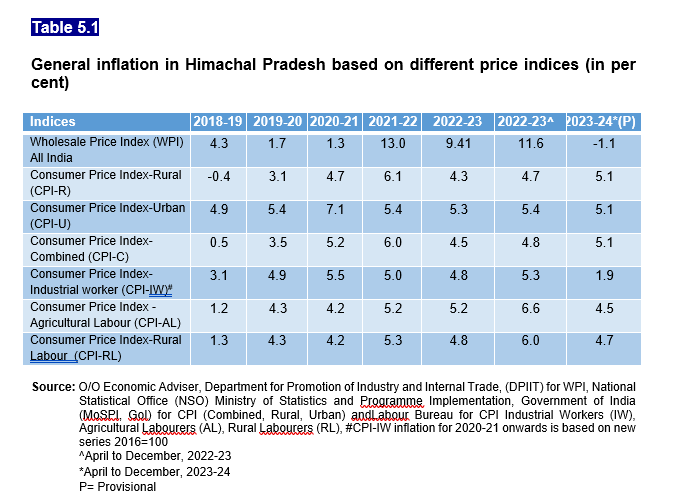

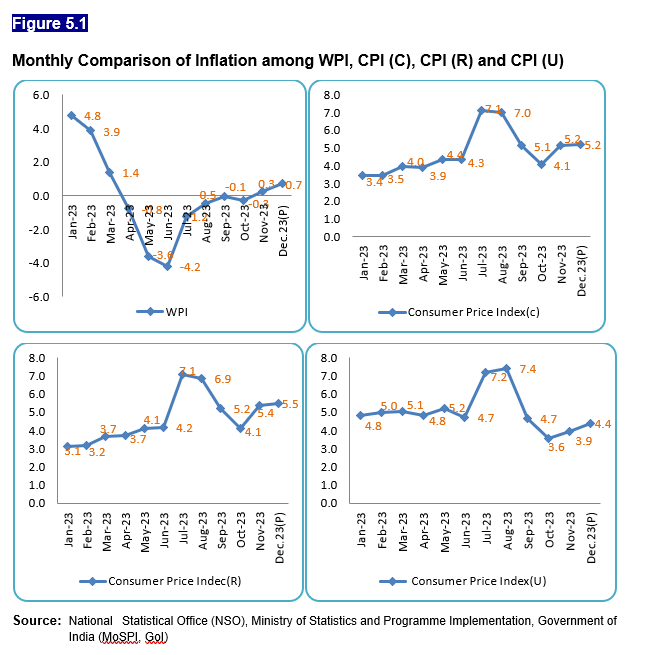

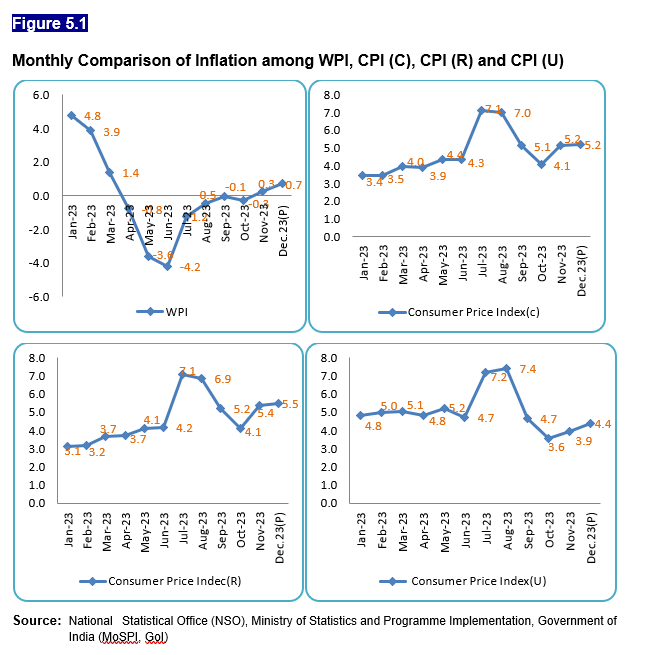

WPI at the state level fell from 11.6 per cent to (-)1.1 per cent in FY 2023-24. This significant decline was attributed to factors such as a slowdown in the inflation of key commodities (crude oil, iron, aluminium, and cotton) and the influence of the base year's high prices. The Consumer Price indices based inflation fluctuated between 1.9 and 5.1 per cent during the same period.CPI inflation exceeded the upper tolerance level set by RBI during July and August 2023, primarily due to rising vegetable prices, especially tomatoes.

The convergence of WPI and CPI was influenced by the decline in commodity prices, specifically commodities like crude oil, iron, aluminium, and cotton. These commodities, which have a significant weight in the WPI basket, experienced a slowdown in inflation. The factor contributing to higher CPI was the rising service costs, which are not included in the WPI basket. This reflects that the convergence of the two inflation indicators was a result of commodity prices levelling down and the impact of rising service costs, which are not considered in the WPI.

a) Divergence in WPI and CPI:

a) Divergence in WPI and CPI: The divergence between relatively high WPI inflation and lower CPI inflation widened from May 2023 to August 2023. Figure 5.1 likely visually represents this divergence.

b) Factors Contributing to Divergence: The divergence is attributed to different weights assigned to the two indices and the lag time in the impact of rising import costs on consumer prices. The WPI, being more volatile due to these factors, reflects the impact of rising import costs more rapidly.

c) The trend towards Convergence: Despite the initial divergence, there has been a narrowing of the gap between WPI and CPI since then, indicating a trend towards convergence. This convergence suggests a balance in the impact of rising import costs on both wholesale and consumer prices.

d) Core Inflation and Government Focus: The core inflation, which is an indicator of demand-pull inflation, has seen little movement recently. Despite this, Himachal Pradesh Government places a high premium on controlling inflation, emphasizing its commitment to maintaining price stability.

e) Impact on Ordinary People: Personal income is not tied to prices, indicating that when inflation occurs, ordinary people suffer disproportionately. This highlights the adverse effects of inflation on the purchasing power and living standards of individuals.

f) Indices for Measuring Inflation: Various indices are mentioned as tools for measuring the ups and downs of inflation:

i) Wholesale Price Index (WPI)

ii) Consumer Price Index-Rural (CPI-R)

iii) Consumer Price Index-Urban (CPI-U)

iv) Consumer Price Index-Combined (CPI-C)

v) Consumer Price Index-Industrial Worker (CPI-IW)

vi) Consumer Price Index-Agriculture Labourers (CPI-AL)

vii) Consumer Price Index-Rural Labourers (CPI-RL)

g) Diverse Tracking of Inflationary Trends: These indices represent different segments of the population, such as rural and urban consumers, industrial workers, and agriculture labourers, and a combined index that encompasses various demographic groups. The diversity in indices reflects the recognition that inflation affects different groups in society, differently.

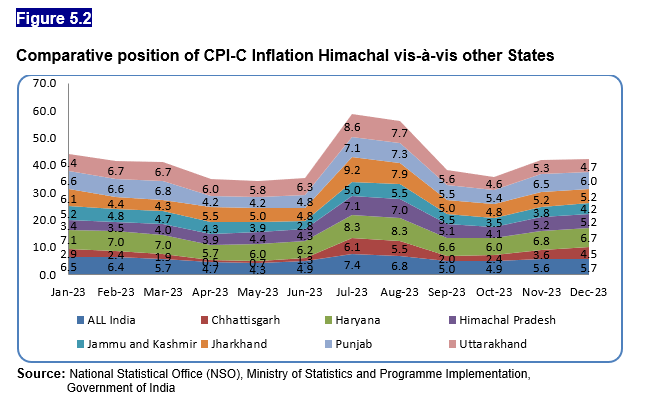

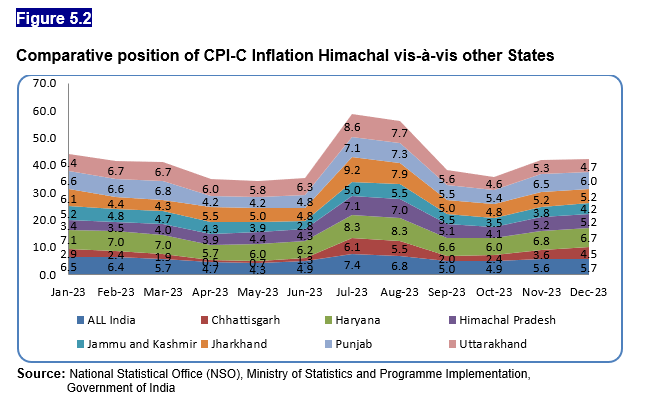

Consumer Price Index-Combined (CPI-C) Inflation among other States: The inflation trend in Himachal Pradesh, as described, reflects a fluctuating pattern throughout the year 2023. Starting at 3.4 per cent in January and peaking at 7.1 per cent in July, the increase in inflation can be attributed to a spike in vegetable prices. This phenomenon could be due to various factors such as weather conditions affecting crop yields, transportation costs, or other supply chain disruptions.

Central banks often raise interest rates to cool down an overheating economy and control inflation. However, it's important to note that the impact of interest rate changes on inflation is not immediate and takes time to manifest.

The subsequent decrease in inflation from September 2023 suggests that either the measures taken, including the interest rate hike, had a positive effect or that the initial factors causing the spike in vegetable prices may have alleviated.

In January 2023, Himachal Pradesh had a CPI-C inflation rate of 3.4 per cent. Himachal Pradesh had relatively moderate inflation compared to other states. The inflation rates in the remaining states ranged from 7.1 per cent to 5.2 per cent.

This disparity in inflation rates among states can be attributed to various factors, including differences in economic activities, supply chains, agricultural production, and regional economic policies. The lower inflation rate in Himachal Pradesh, in comparison to most other states, indicates a relatively stable economic environment and effective measures taken by the State to control inflation.

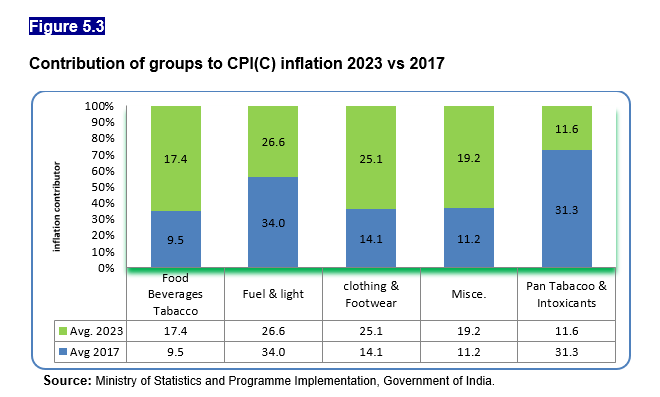

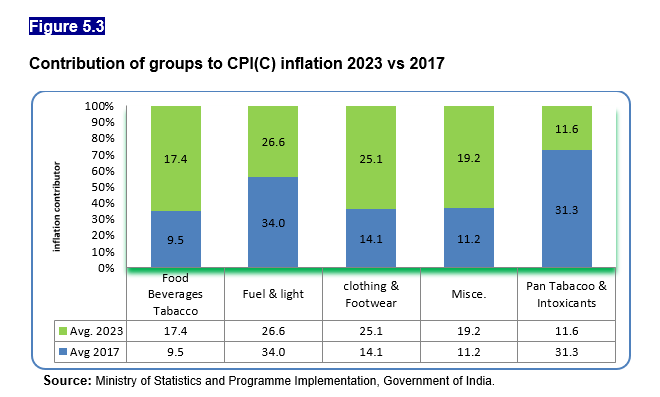

Drivers and contributors to Consumer Price Index inflation (Combined) 2023 vs 2017 Figure 5.3:

a) Retail Inflation Driven by Following Commodities:

i) Fuel and Light:

1.

Drivers and contributors to Consumer Price Index inflation (Combined) 2023 vs 2017 Figure 5.3:

a) Retail Inflation Driven by Following Commodities:

i) Fuel and Light:

1. Largest contributor to overall inflation.

2. Accounts for 26.6 per cent of the total CPI-C inflation.

3. Indicates that changes in fuel and energy prices significantly influence the overall inflation rate.

ii) Clothing and Footwear:

1. The main driver of CPI-C inflation with a 25.1 per cent contribution.

2. Reflects the impact of price changes in clothing and footwear on the overall inflation rate.

iii) Miscellaneous:

1. Contributes to the overall inflation, with 19.2 per cent share.

2. "Miscellaneous" typically includes a variety of goods and services not classified under other major categories.

iv) Food and Beverages:

1. Contributes to the overall inflation, with 17.4 per cent share.

2. Indicates the influence of food and beverage price changes on the overall inflation rate.

v) Pan Tobacco & Intoxicants:

1. Contributes 11.6 per cent to the total inflation.

2. This category involves products like tobacco and intoxicants, and its contribution suggests its impact on the inflation rate.

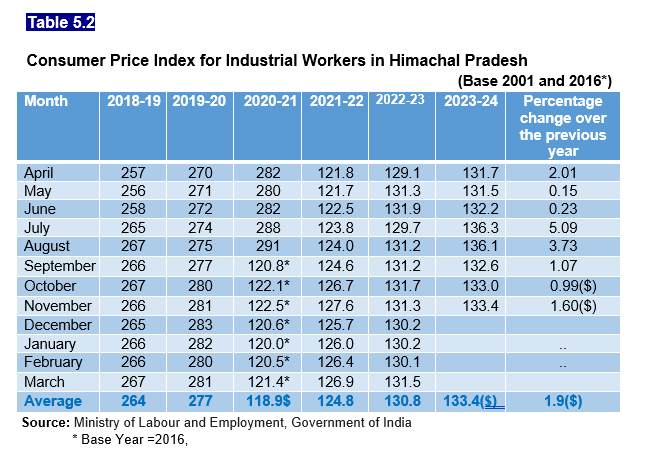

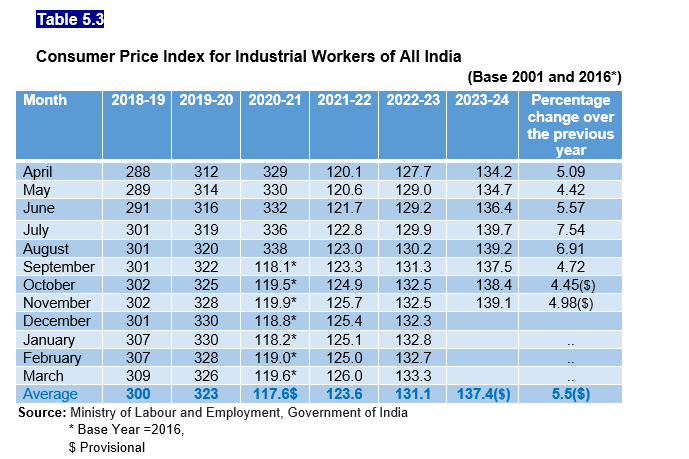

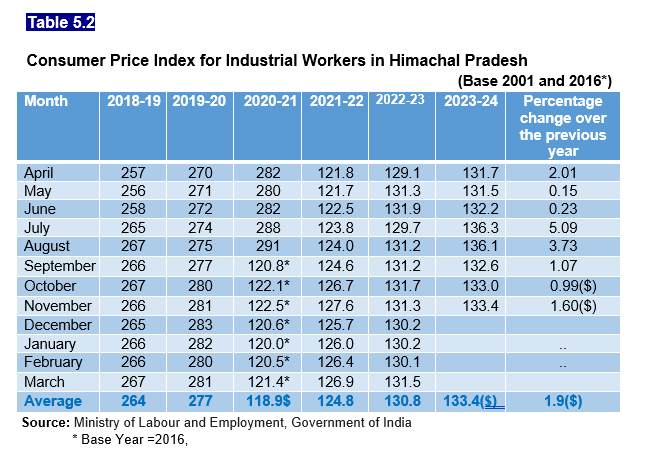

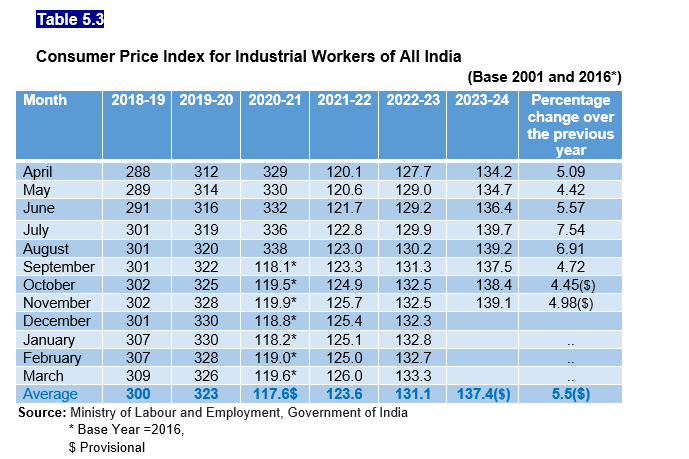

Consumer Price Index Industrial Worker (CPI-IW):

Consumer Price Index Industrial Worker (CPI-IW):The Consumer Price Index for Industrial Workers (CPI-IW) is a measure of inflation specific to the cost of living for industrial workers and is released by the Labour Bureau. The base year for CPI-IW was changed from 2001 to 2016 in September, 2020. The index includes industrial employees from various sectors such as factories, mines, plantations, railroads, public motor transport undertakings, energy generating and distributing enterprises, as well as ports and docks.

The information provided in Table 5.2, 5.3 and Figure 5.4 indicates that in November, 2023 the CPI-IW inflation in Himachal Pradesh was lower than the national average.

This could be due to various factors such as regional economic conditions, differences in the composition of industries, and specific factors affecting the cost of living in Himachal Pradesh. The lower CPI-IW inflation in the state might have positive implications for the purchasing power and standard of living of industrial workers in comparison to the national average.

Wholesale Price Index (WPI):

Wholesale Price Index (WPI):Wholesale Price Index (WPI)-based inflation during and after the Covid-19 era, with additional impact from the Russia-Ukraine war. Overall, the monthly trend of inflation rates based on wholesale prices has been sliding downwards from its peak of 4.8 per cent in January, 2023 to (-) 4.2 per cent in June, 2023 and further increased to 0.7 per cent in December, 2023. (Figure: 5.1). The key points are mentioned below:

a) Low WPI-based Inflation during the Covid-19 Era:

i) WPI-based inflation remained low throughout the COVID-19 period. This is attributed to the economic slowdown and disruptions caused by the pandemic, which lead to reduced demand and pricing pressures.

b) Increase in WPI-based Inflation after the Epidemic:

i) As economic activity restarted post the Covid-19 pandemic, WPI-based inflation began to gain momentum. Economic recovery often leads to increased demand for goods and services, which can contribute to upward pressure on prices.

c) Impact of Russia-Ukraine War:

i) The Russia-Ukraine war is a factor contributing to the increase in WPI-based inflation.

ii) Disruption of global supply networks and disruption of free flow of key goods due to geopolitical events, such as wars, can lead to supply shortages and increase production costs, influencing inflation rates.

d) Negative WPI in FY 2023-24:

i) The wholesale inflation rate decreased to almost negative up to October in FY 2023-24.

ii) The negative inflation rate indicates a period of deflation, where the average prices received by producers for their goods and services decreased, possibly reflecting the challenges in the supply chains and economic uncertainties.

e) Consequences of Disruptions:

i) The disruptions caused by both the COVID-19 pandemic and geopolitical events have consequences on global supply chains, trade, and economic activities, impacting inflation rates.

f) WPI Inflation Fluctuations Main Points:

i) Imported Inflation and WPI:

1) Imported inflation contributes to WPI inflation, with a specific mention of the impact on edible oils.

2) The temporary impacts of higher worldwide costs for items, especially edible oils, are reflected in local pricing.

ii) RBI Study on Global Inflation Shock:

1) According to an RBI study, a one per cent increase in prices across all countries and sectors due to a global inflation shock could raise inflation in India.

2) The second-round effects include domestic indirect effects (46 basis points) and global spillovers (17 basis points), in addition to the direct impact of 100 basis points.

iv) Influence on WPI (Manufactured Goods Component): The influence of global market prices on WPI, particularly in the prices of oil and basic metals, is noticeable, especially in the manufactured goods component.

v) Global Prices for Various Commodities:

1) Global prices for edible oils, rubber, cotton, crude oil, and metals have fallen in the current fiscal year.

2) Fluctuations in global commodity prices can have significant implications for countries that rely on imports for these commodities.

v) Capital Outflows and Currency Rate:

1) Capital outflows had a negative influence on India's currency rate in the first half of FY 2023-24.

2)This contributed to the high costs of imported inputs, especially those denominated in dollars.

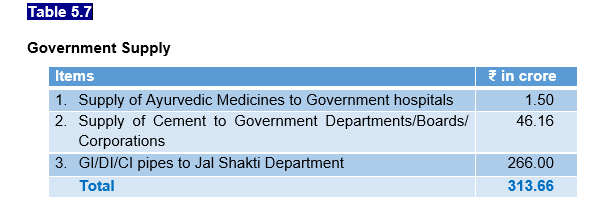

Monthly Wholesale Price Index (WPI):Through a network of District Statistical Offices, the Department of Economics and Statistics collects compiles and analyses data on 160 commodities. Every first Friday of the month, the prices are collected from the district's designated shops. These rates are made accessible to stakeholders after being scrutinised at headquarters. Show in figures 5.6 and 5.7.

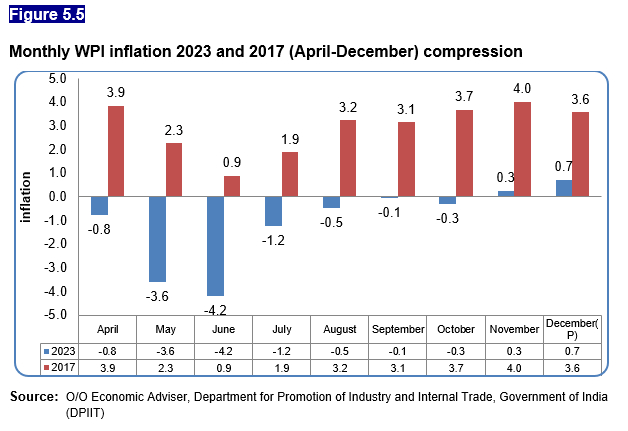

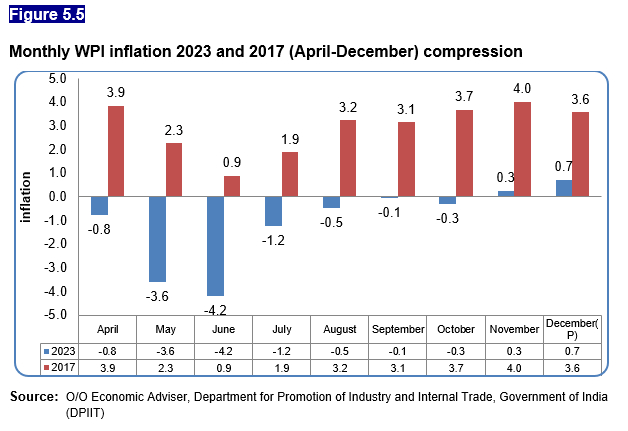

The Monthly Wholesale Price Index, at the National level for the State during December, 2022 was 150.5 which increased to 151.6 (P) in December, 2023 showing an inflation rate of 0.7 per cent. The month-wise average WPI for the year 2023-24 is given in Figures: 5.1 and 5.5.

The information from Figure 5.5 indicates a comparison of Wholesale Price Index (WPI) inflation between two periods: April to December, 2023 and April to December, 2017. Here are the key observations:

a) WPI Inflation in April to December, 2023:

i) In the more recent period of April to December, 2023, WPI inflation fell into negative territory, ranging between (-) 4.2 to 0.7 per cent.

ii) The negative inflation indicates a period of deflation, where average prices received by producers for their goods and services decreased.

b) WPI Inflation in April to December 2017:

i) From April to December 2017, WPI inflation ranged between 0.9 and 4.0 per cent.

ii) This suggests a relatively moderate to low level of inflation during that period.

c) Significant Decline in WPI Inflation:

i) The data reveals a significant decline in WPI inflation between the two periods, with the more recent period experiencing negative inflation rates.

ii) This decline suggests that overall, wholesale prices have decreased or remained subdued, indicating potential stability or even a decrease in retail prices.

d) Implications for Retail Prices:

i)The conclusion drawn is that with the significant decline in WPI inflation, retail prices in India are expected to stay steady or fall in the next months.

ii) Lower wholesale prices can potentially translate into lower costs for retailers and may contribute to stability or reduction in consumer prices.

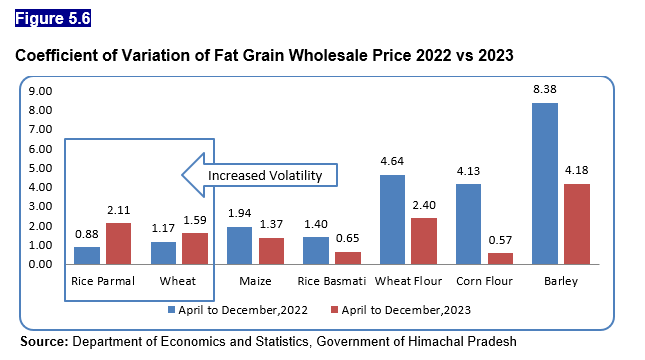

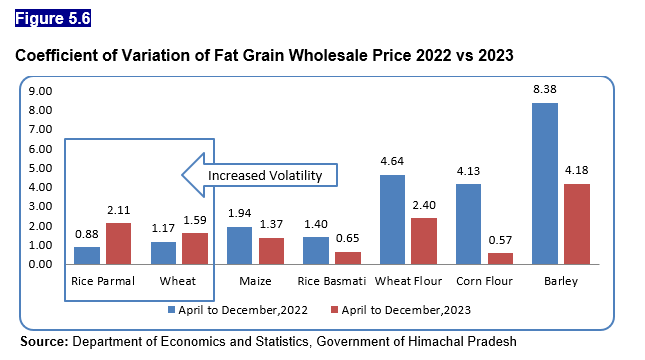

e) Wholesale Price Coefficient of Variation of 2022 and 2023 (Figure 5.6 and Figure 5.7):

a) Visual Representation: The figures, particularly Figure 5.6 and Figure 5.7, are likely visual representations of the coefficient of variation for the prices of fat grains and pulses, respectively. These figures can provide a graphical representation of the volatility trends in wholesale prices for the mentioned commodities.

b) Analysis of Fat Grain Wholesale Prices (Figure 5.6):

i) The coefficient of variation is employed to analyze the volatility of wholesale prices for fat grains in 2022 (April to December) and 2023 (April to December).

ii) The focus is on commodities like wheat and rice parmal, which are identified as highly volatile during 2023-24.

f) Factors Affecting Pulse Prices (Figure 5.7):

i)

f) Factors Affecting Pulse Prices (Figure 5.7):

i) The coefficient of variation in pulses remained subdued due to increased production, government initiatives to maintain buffer stocks, and lower import taxes and cess on pulses.

ii) Increased production levels contribute to the stability of the prices of pulses.

g) High Volatility in Specific Pulses:

i)

g) High Volatility in Specific Pulses:

i) Certain pulse commodities, including Chickpeas, Kabuli channa, Arhar dal, Chane dal, Moong, Urd, Masur Dal, and Malka, are identified as highly volatile based on the coefficient of variation calculations for 2022 (April to December) and 2023 (April to December).

ii) This indicates that the prices of these specific pulse commodities experienced significant fluctuations during the mentioned periods.

h) Stability in Other Pulses:

i) On the other hand, commodities like Kulth, Rajmah, and Soyabean are identified as less volatile, staying stable throughout the year.

ii) The stability in these pulse commodities may be attributed to factors such as consistent production levels or effective market interventions.

Inflation CPI (IW) vs repurchasing option rate (Repo Rate):This information discusses the challenges associated with higher inflation, especially in the context of fiscal policy and its impact on various economies. Here are the key points:

a) Political Ramifications of Rising Inflation:

i) Higher inflation rates can have political ramifications, particularly when they coincide with the budgeting process.

ii) Political leaders may face challenges in managing public expectations and addressing concerns related to the cost of living.

b) Global Economic Challenges in 2023:

i) Many economies faced difficulties in 2023, even as some were recovering from the impact of the COVID-19 pandemic.

ii) Ongoing geopolitical issues, such as the war between Russia and Ukraine and the Israeli–Palestinian conflict, have created supply-side constraints, impacting global economic conditions.

c) Unmanageably High Rates of Inflation:

i) Most nations have entered a problematic zone marked by unmanageably high rates of inflation.

ii) High inflation can erode purchasing power, disrupt economic stability, and pose challenges for both consumers and businesses.

d) Repo Rate as a Tool for Mitigating Inflation:

i) The repo rate is mentioned as an effective method for mitigating inflation.

ii) The repo rate, or repurchase rate, is the interest rate at which the central bank (Reserve Bank of India) lends money to commercial banks and other financial institutions.

e) Financial Crisis and Central Bank Intervention:

i) During financial crises, banks often turn to the central bank for support.

ii) The Reserve Bank of India (RBI) plays a crucial role in managing monetary policy, including using tools like the repo rate to influence the money supply and inflation levels.

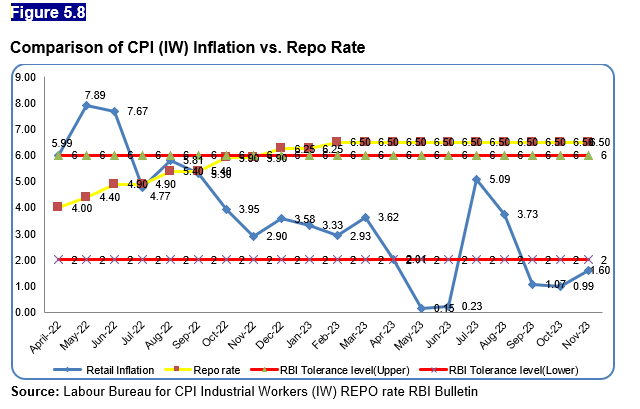

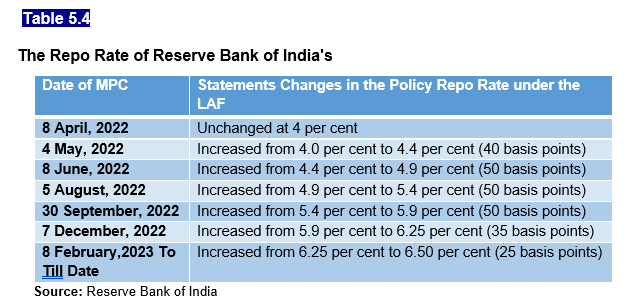

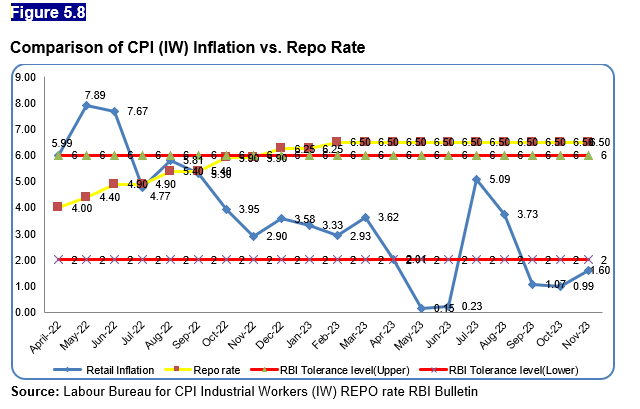

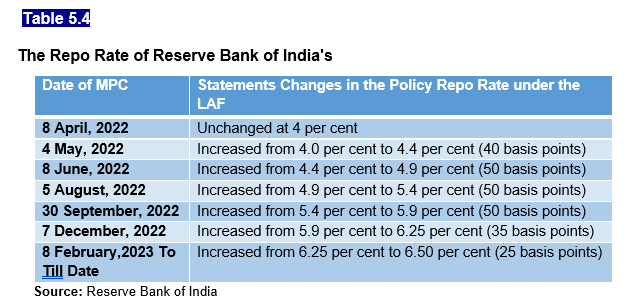

The dynamics of inflation in 2022 and 2023, particularly focusing on measures taken by the Reserve Bank of India (RBI) and the Central Government to address inflationary pressures in figure 5.8 below are the main findings:

f) Retail Inflation exceeding RBI's Tolerance Limit in 2022:

i)

f) Retail Inflation exceeding RBI's Tolerance Limit in 2022:

i) Instances in 2022 when retail inflation exceeded the RBI's tolerance limit.

ii) The RBI's Monetary Policy Committee (MPC) responds by calling for a rise in the repo rate to control inflation.

g) Repo Rate Hike by the RBI:

i) CPI (IW) inflation reached a high of 7.89 per cent in May 2022, exceeding the RBI's tolerance level of 6.0 per cent.

ii) From May to December, 2022, and up to February, 2023 the MPC raised the policy repo rate under the Liquidity Adjustment Facility (LAF) by 225 basis points, from 4.0 per cent to 6.50 per cent, to tackle inflation.

iii) This indicates a proactive approach by the RBI to use monetary policy tools to curb inflation.

h) Impact on Inflation:

i) As a result of the measures taken, inflation came down, with CPI inflation reaching and went into the lower tolerance level of 2.0 per cent during May and June, 2023.

I) Inflation Spike in July and August, 2023:

i) A sudden spike in inflation was noted in July and August 2023, attributed to a rise in vegetable prices, especially tomatoes.

ii) However, the situation has cooled down, and inflation is reported to be moving between the tolerance levels set by the RBI.

j) Recent REPO Rate:

i) The RBI increased the REPO rate by 25 basis points from February 8th, 2023.

ii) The rate hike was followed by a decrease in retail inflation from 7.89 per cent in May 2022 to 0.15 per cent in May 2023.

Weekly Retail Price :

Weekly Retail Price :The District Statistical Offices in Himachal Pradesh are part of the Department of Economic and Statistics for collecting and analysing data on basic goods. Every Friday, prices are gathered from participating shops in the district and, after being verified, posted at www.weeklyprices.hp.gov.in. The Director of the Department of Food Supplies and Consumer Affairs, as well as the Economics and Statistics Department, Government of Himachal Pradesh, receives a report every week detailing the previous week's pricing changes.

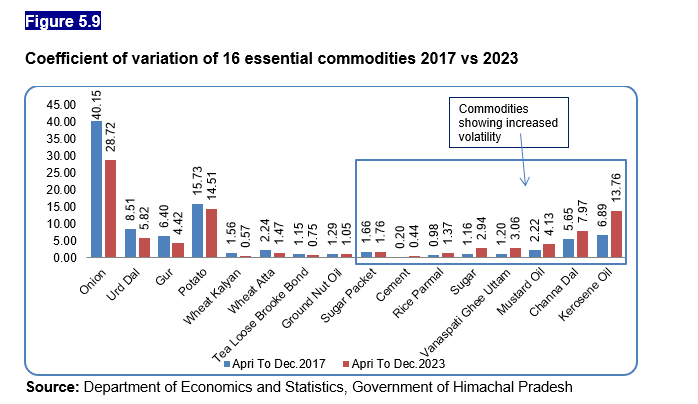

Volatility in Essential Commodity Prices:

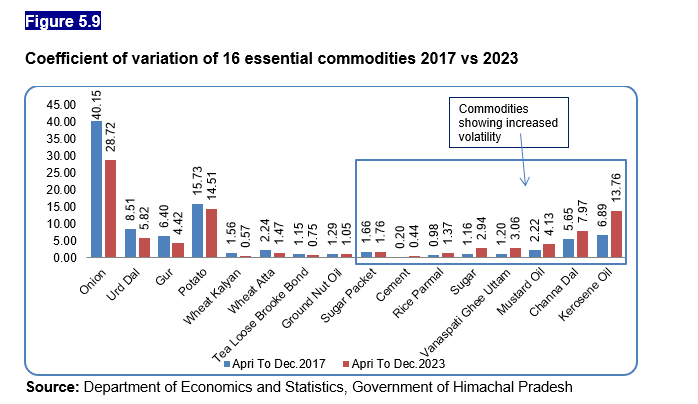

Volatility in Essential Commodity Prices: The scarcity of available workers, possibly due to COVID-19 regulations, may have contributed to an increase in retail prices. Additionally, the analysis of price fluctuations for various commodities between April to December, 2017 and April to December, 2023 reveals distinct trends. Below are the observations (Figure 5.9):

a) Possible Impact of Worker Scarcity:

i) The scarcity of available workers is mentioned as a potential factor contributing to the increase in retail prices following the implementation of COVID-19 regulations.

ii) Labour shortages can disrupt supply chains, leading to production challenges and affecting prices.

b) Commodities with Stable Prices Since (April to December, 2023):

i) Certain commodities, including Onion, Urd dal, Gur, Potato, Wheat Kalyan, Wheat atta, Tea loose Brooke Bond, and Groundnut oil, have remained stable since April, 2023.

ii) Stability is attributed to factors such as adequate supply resulting from domestic production and the maintenance of adequate buffer stocks for rice and wheat to meet food security requirements.

c) Volatility in Prices for Specific Commodities (April to December, 2023):

i) Kerosene oil, Channa dal, Mustard oil, Uttam vanspati ghee, Sugar, Rice parmal, Cement, and Sugar packet all experienced volatility in prices between April to December, 2023.

ii) These commodities saw fluctuations, suggesting that various factors such as demand, supply chain disruptions, or external influences may have affected their prices.